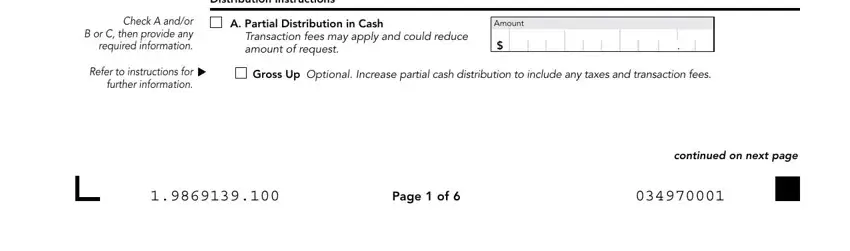

A wire processing fee of $15 will be deducted from the distribution |

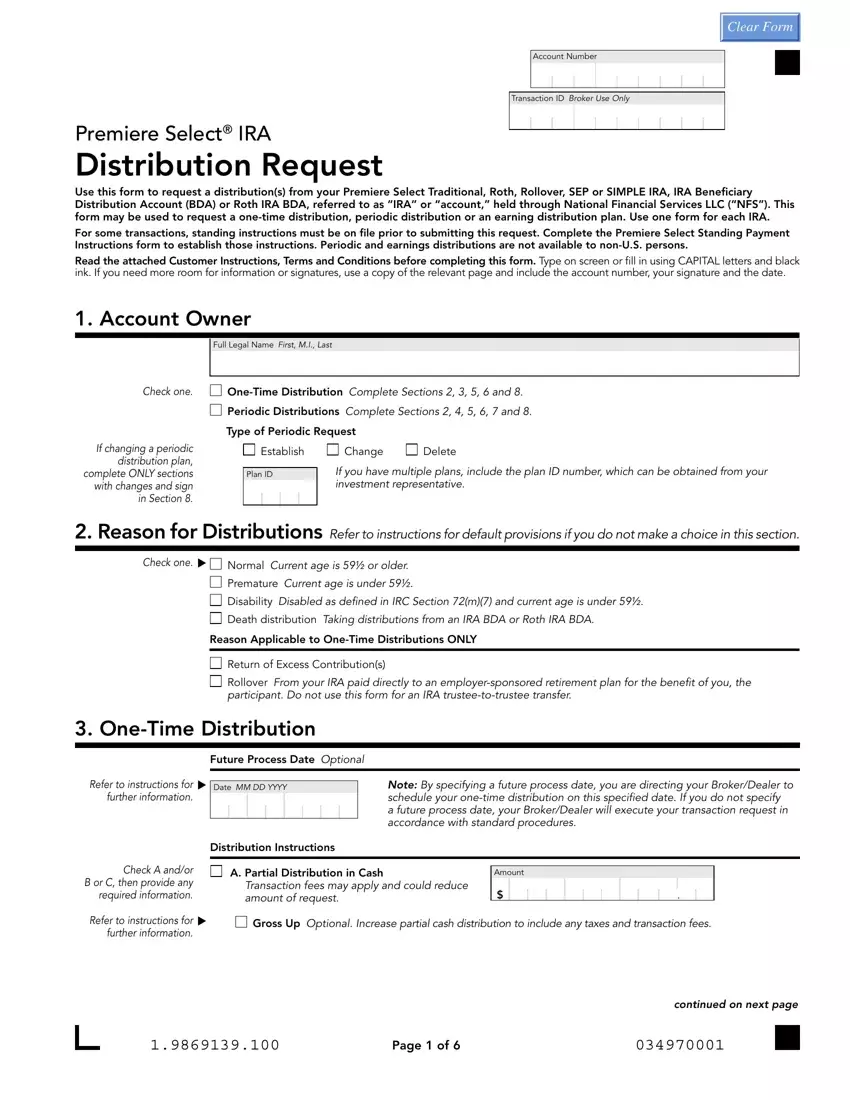

If you elect to have withholding apply (by indicating so on your |

amount indicated on this form, and will affect your reporting |

distribution request, by making no choice, or by not providing a U.S. |

distribution account. For example, if you request a distribution |

residential address), federal income tax will be withheld from your |

of $1,000, and you do not select the Gross Up option, both |

taxable IRA distributions (excluding qualified Roth IRA and Roth IRA |

the distribution amount wired to your bank account and the |

BDA distributions) at a rate of at least 10% (30% for non-U.S. residents). |

distribution amount reported on IRS Form 1099-R will be $985. |

Federal income tax will not be withheld from a Roth IRA or Roth IRA |

The receiving bank may also charge a fee for the receipt of the |

BDA unless you elect to have such tax withheld. |

Bank Wire. |

|

|

Your state of residence will determine your state income tax |

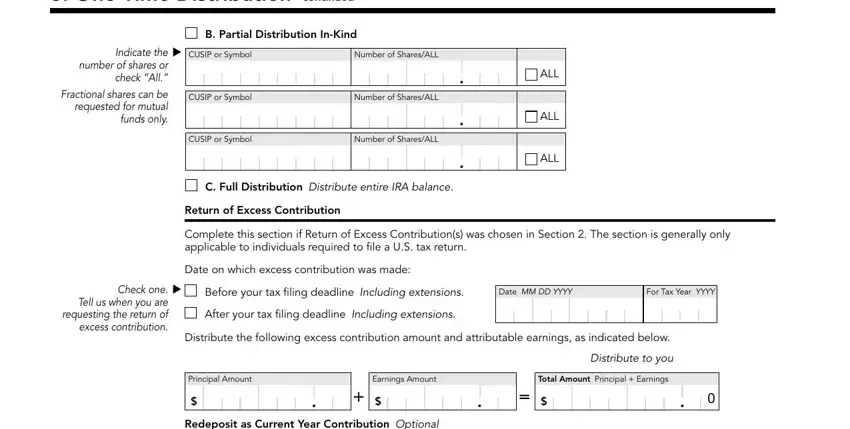

D. Distribution to a Nonretirement Account (via Journal) |

withholding requirements, if any. Refer to the list below. Your state of |

If you want cash or securities distributed in-kind to a nonretirement |

residence is determined by your legal address of record provided for |

account, provide the nonretirement account number. An application |

your IRA. The information provided is general in nature and should not |

must be completed to establish a new nonretirement brokerage |

be considered legal or tax advice. |

account. |

|

|

Whether or not you elect to have federal, and if applicable, state |

6. Notice of Withholding |

|

|

income tax withheld, you are still responsible for the full payment of |

|

|

federal income tax, any state tax or local taxes, and any penalties that |

|

|

|

|

|

|

Read carefully before completing the Tax Withholding Elections section |

may apply to your distributions. Whether or not you elect to have |

of the form. |

|

|

withholding apply (by indicating so on your distribution request), you |

Your IRA distributions, other than qualified Roth IRA and Roth IRA |

may be responsible for payment of estimated taxes. You may incur |

BDA distributions, are subject to federal (and in some cases, state) |

penalties under the IRS and applicable state tax rules if your estimated |

income tax withholding unless you elect not to have withholding apply. |

tax payments are not sufficient. |

Withholding will apply to the gross amount of each distribution, even |

If you are not a U.S. person, you must have previously submitted IRS |

if you have made non-deductible contributions. Moreover, failure to |

Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for |

provide a U.S. residential address will result in 10% federal income tax |

United States Tax Withholding. To obtain Form W-8BEN, consult your |

withholding on the distribution proceeds even if you have elected not |

tax advisor or go to the IRS website at http://www.irs.gov. |

to have tax withheld (an IRS requirement as applicable). A Post Office |

|

Box or Personal Mail Box does not qualify as a residential address. |

|

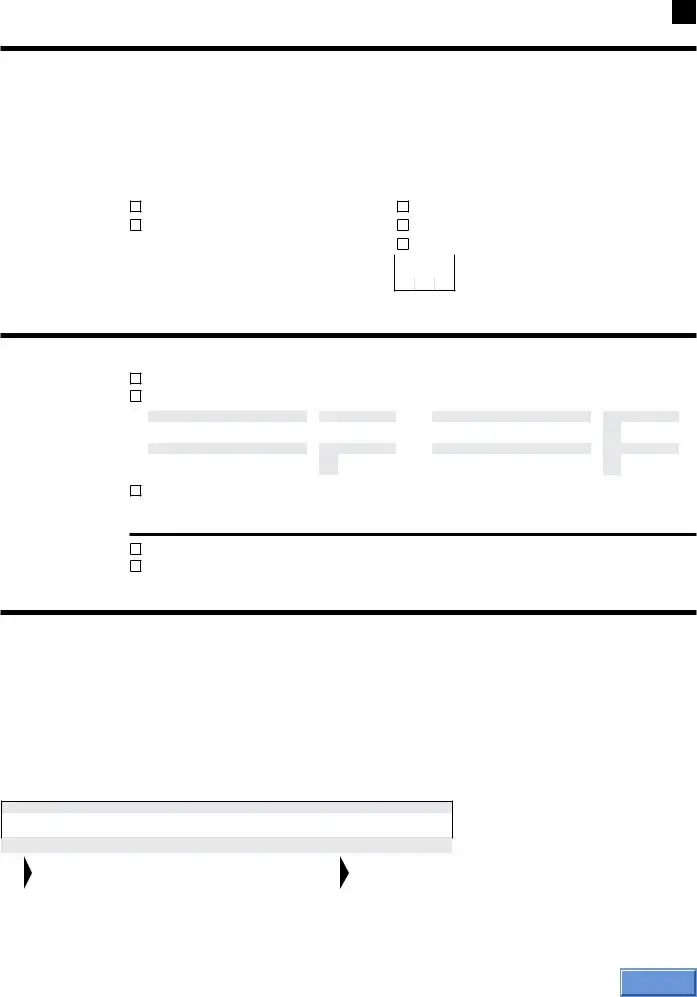

Withholding Options |

|

|

|

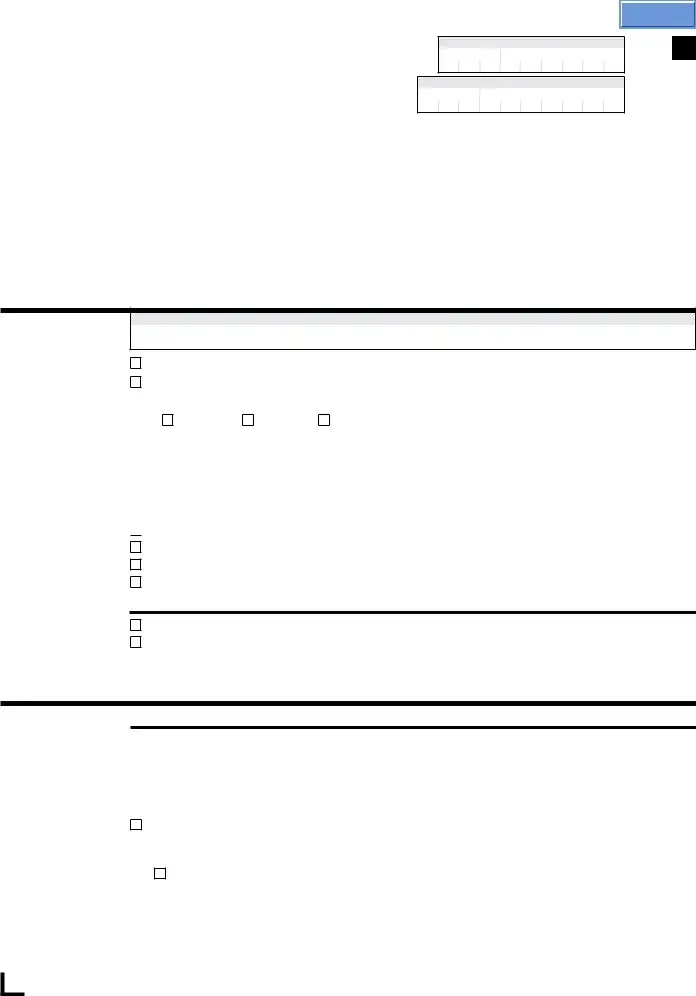

State of residence |

State tax withholding options |

|

|

|

|

AK, FL, HI, NH, NV, |

• No state tax withholding is available (even if your state has income tax). |

SD,TN, TX, WA, WY |

|

|

|

AR, IA, KS, MA, ME, |

• If you choose federal withholding, you will also get state withholding at your state’s minimum withholding rate or an |

OK, VT |

amount greater as specified by you. |

|

|

• If you do NOT choose federal withholding, state withholding is voluntary. |

|

• If you have state withholding, you can request a higher rate than your state’s minimum but not a lower rate, except |

|

on Roth IRA distributions. |

|

CA, DE, NC, OR |

• If you choose federal withholding, you will also get state withholding at your state’s minimum withholding rate unless |

|

you request otherwise. |

|

|

• If you do NOT choose federal withholding, state withholding is voluntary. |

|

• If you have state withholding, you can request a higher rate than your state’s minimum but not a lower rate, except |

|

on Roth IRA distributions. |

|

DC |

• If you are taking distribution of your entire account balance and not directly rolling that amount over to another |

Only applicable if taking |

eligible retirement account, DC requires that a minimum amount be withheld from the taxable portion of the |

a full distribution of entire |

distribution, whether or not federal income tax is withheld. In that case, you must elect to have the minimum DC |

account balance. |

income tax amount withheld by completing the Tax Withholding section. |

|

• If your entire distribution amount has already been taxed (for instance only after-tax or nondeductible contributions |

|

were made and you have no pre-tax earnings), you may be eligible to elect any of the withholding options. |

|

• If you wish to take a distribution of both taxable and nontaxable amounts, you must complete a separate distribution |

|

request form for each and complete the Tax Withholding section of the forms, as appropriate. |

MI |

• MI generally requires state income tax of at least your state’s minimum requirements regardless of whether or not |

|

federal income tax is withheld. |

|

|

• Tax withholding is not required if you meet certain MI requirements governing pension and retirement benefits. |

|

Reference the MI W-4P Form for additional information about calculating the amount to withhold from your |

|

distribution. |

|

|

• If you are subject to MI state tax withholding, you must elect state tax withholding of at least your state’s minimum |

|

by completing the Tax Withholding section. |

|

|

• Contact your tax advisor or investment representative for additional information about MI requirements. |

|

|

|

MS |

• If you choose federal withholding, you will also get state withholding at your state’s minimum withholding rate unless |

|

you request otherwise. |

|

|

• If you do NOT choose federal withholding, state withholding will occur unless you request otherwise. |

|

• If you have state withholding, you can request a higher rate than your state’s minimum but not a lower rate, except |

|

on Roth IRA distributions. |

|

OH |

• State tax withholding is voluntary. If you choose state withholding, you can choose a higher rate than your state’s |

|

minimum but not a lower rate, except on Roth IRA distributions. |